Which Asset Is Not Depreciable Select All That Apply

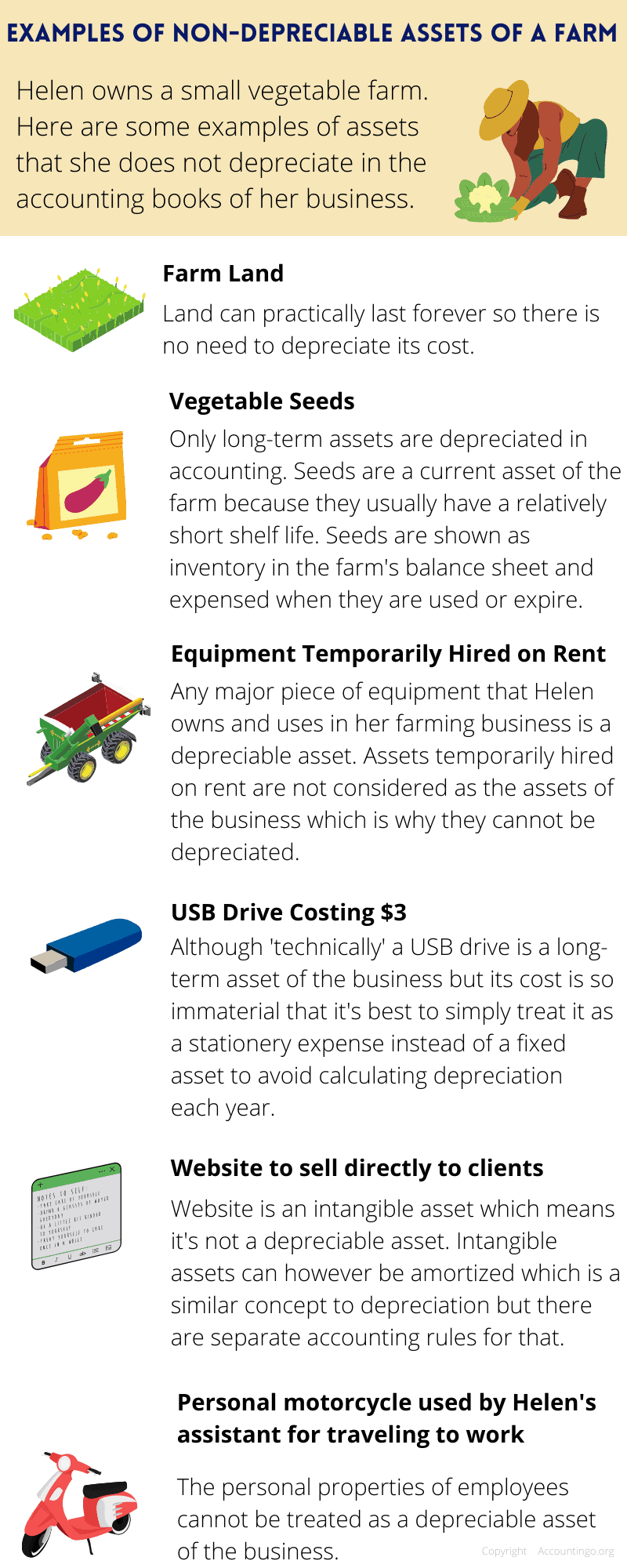

However land in and of itself is not depreciable. When you sell a depreciable property for less than its original capital cost but for more than the undepreciated capital cost UCC in its class you do not have a capital gain.

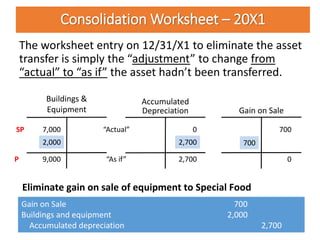

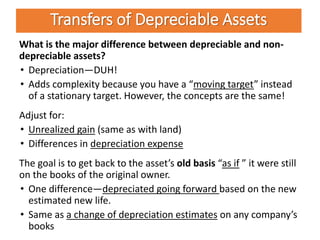

Intercompany Transactions Of Non Current Assets Depreciable Assets

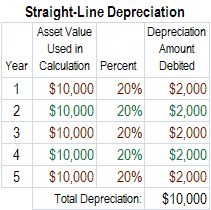

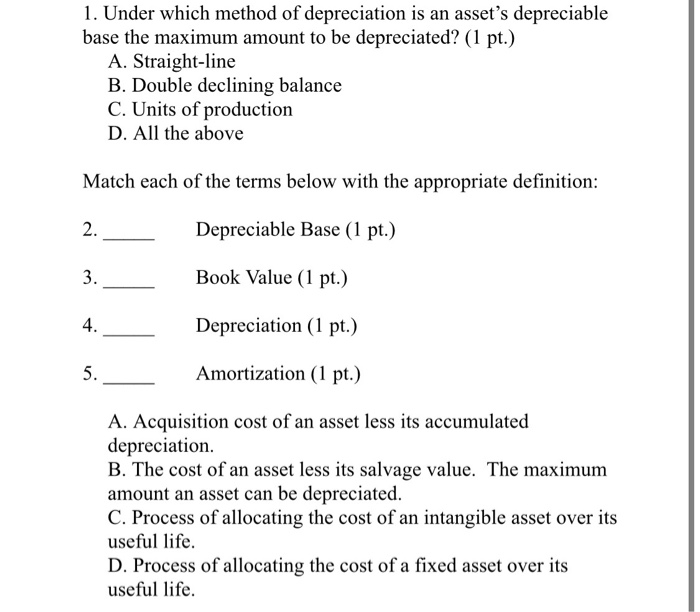

Expense 100 Useful life of asset x 2.

. Select all that apply. Select all that apply a. Select all that apply.

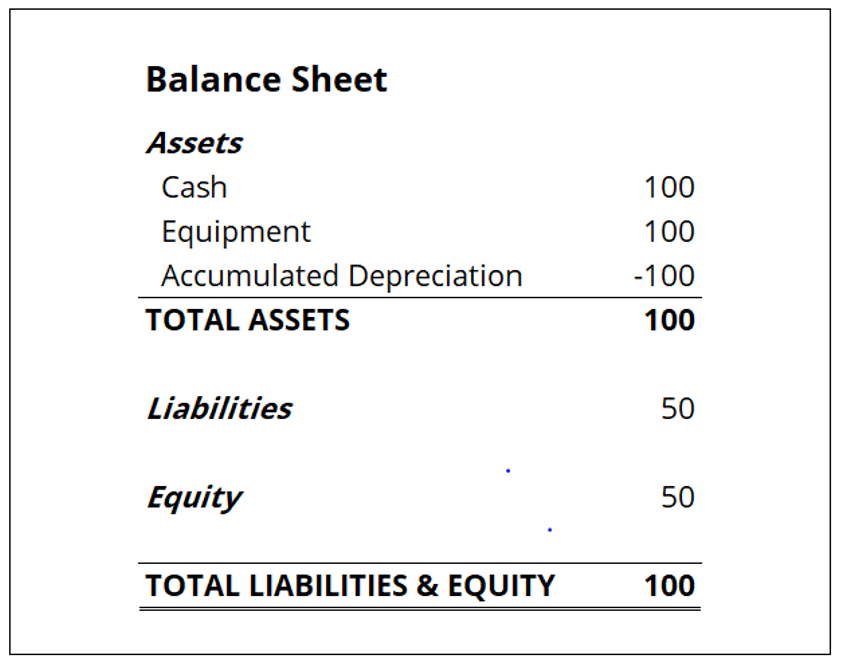

Amortization is the practice of spreading an intangible assets cost over that assets useful life. Evans booktax difference from this sale is. Depreciation is the expensing of a fixed asset over its useful life.

Select all that apply. The trade-in value of an asset at the end of its useful life B. All of the MACRS percentages found in the IRS tables are applied to an assets initial depreciable basis b.

An asset has a depreciable basis of 13200 and qualifies as 3-year MACRS property. Evan Company sold a depreciable asset this year for 100000. You also cant depreciate assets that are purchased and disposed of in the same year otherwise known as current assets Current assets include certain supplies prepaid insurance and accounts receivable amounts owed to your business.

Explanation - Land is fixed assets but it is not depreciable because land has inifinte. Multiply the rate of depreciation by the beginning book value to determine the expense for that year. - may result in no deductible loss if the assets are insured for more than their tax basis.

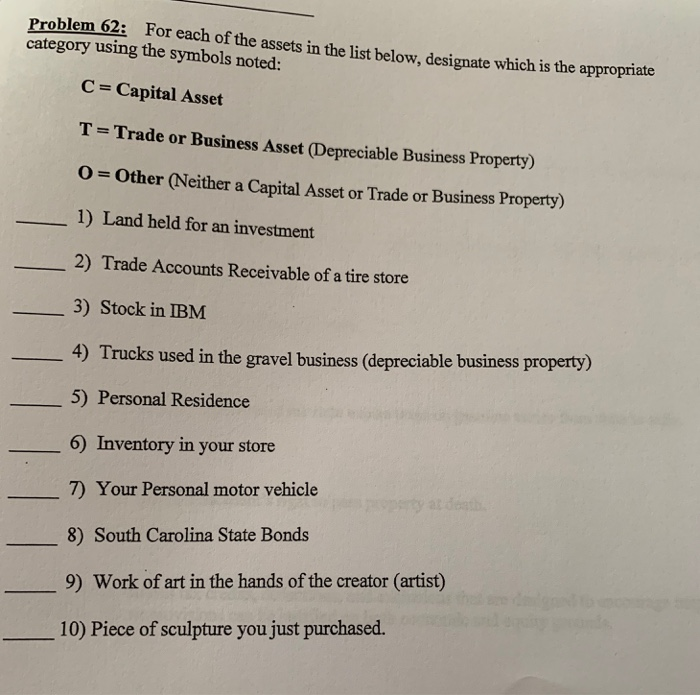

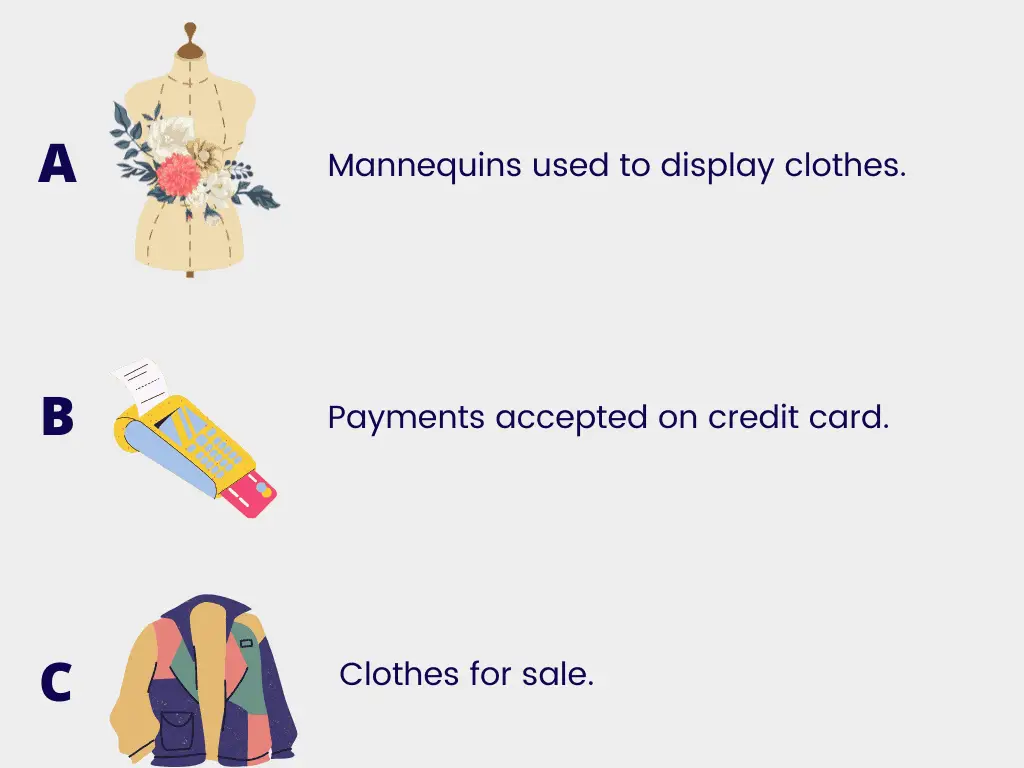

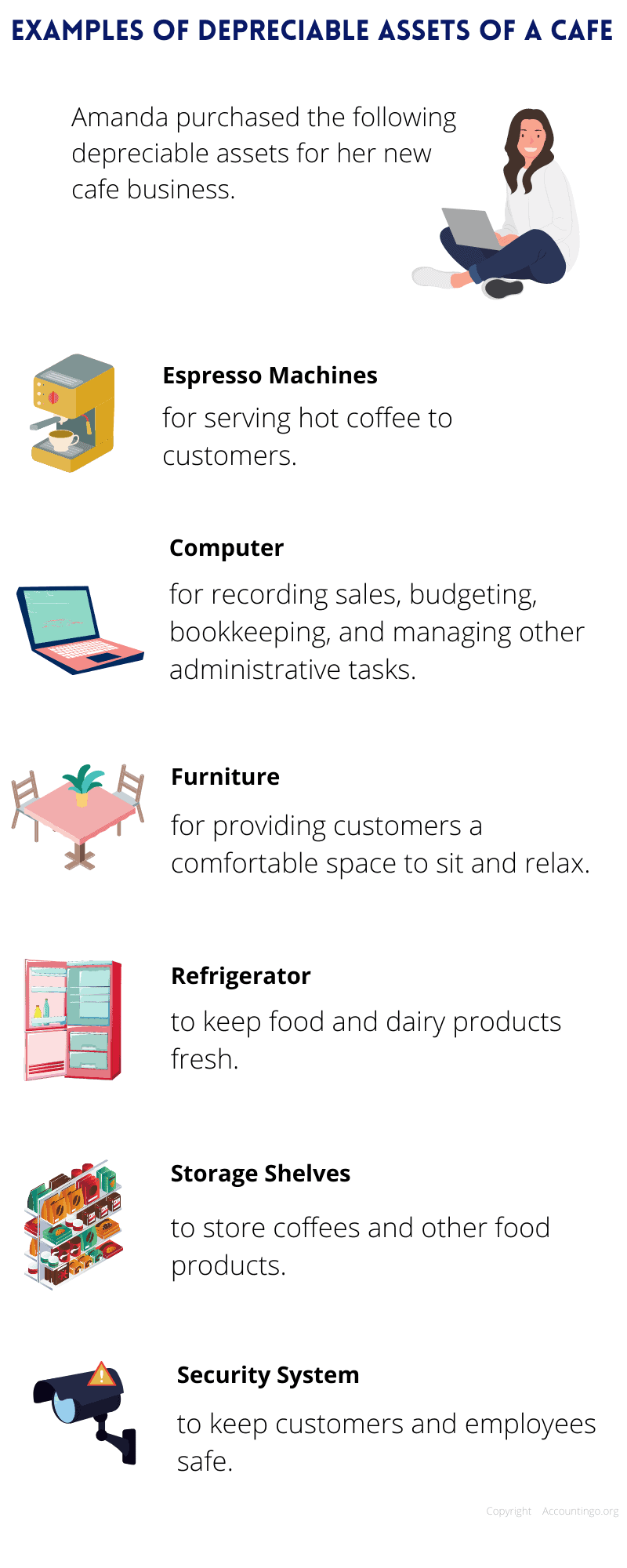

The above assets are classified as depreciable assets because they are primarily used by the business and wear out with time land is not considered a depreciable asset since it naturally appreciates in value over time. The majority of fixed assets are also depreciable assets but there are exceptions. The trade-in value of an asset before it is depreciated C.

Since land s NOT eligible for tax and accounting purposes to register depreciation it therefore not a depreciable asset. Select all that apply. Which of the following observations would NOT alarm the nurse.

Salvage value refers to which of the following. Select all that apply What types of costs are included in an assets depreciable basis. Depreciation rate - 1429.

Land is not a depreciable asset. Given their low cost it is not cost-effective to maintain. Answer- Option A and E not depreciableIe Land and Inventory.

In addition low-cost purchases with a minimal useful life are charged to expense at once rather than being depreciated. An asset has a 3-year life and a depreciable basis of 16400. Show Answer Hide Answer Stntn Inc.

Since this is a double-declining method we multiply the rate of depreciation by 2. Expense 100 8 x 2 25. Instead they are assumed to be converted to cash within a short period of time typically within one year.

What is the depreciation in year 4 273388 Rationale. - produces an ordinary loss equal to the fair market value of the assets. The asset will be depreciated using the straight-line method over its four-year useful life.

MACRS uses the 150 declining balance method with SL switchover for all assets c. Property class- 7 years Date placed in service- 10th September 2016. Falcon Company purchased a depreciable.

The asset had a book basis of 65000 and a tax basis of 53000. If you sell depreciable property in a year you also have to subtract from the. Select all that apply.

Select all that apply Which of the following statements are true. Generally the UCC of a class is the total capital cost of all the properties of the class minus the CCA you claimed in previous years. Check all that applyAt the end of the assets useful life its Accumulated Depreciation will equal the assets depreciable cost book or carrying value will equal the assets residual value Accumulated Depreciation will equal the assets.

How much an asset may be worth as scrap at the end of its useful life D. Accounting questions and answers. Both assets have the same projected life.

Which of these assets are not depeciated select all tha apply 1 machinery 2buildings 3 land 4equipment 5 cash 6inventory. Both assets may produce the same level of sales. Purchase price of the asset An adjustment downward to record the selling price of the asset replaced Sales tax.

Depreciation Year 4 01667 16400 273388. A casualty or theft of business assets. The average useful life for straight-line depreciation for buildings and improvement is 15-44 years and 5-15 years for machinery and equipment.

Similar assets purchased in the same year must be depreciated using the 1 samedifferent depreciation method but similar assets purchased in different years can be depreciated using 2 samedifferent depreciation methods. Select all that apply - produces an ordinary loss equal to the excess of the tax basis of the assets over any insurance reimbursement. Depreciable asset fr 22000 n April 1 Year 1.

MACRS uses DDB for 3- to 10-year property and then switches to SL when SL produces a higher depreciation value d. The MACRS percentages are. Note that an asset that is NOT eligible for tax and accounting purposes to register depreciation in compliance with Internal Revenue Service IRS rules is considered NOT to be depreciable property.

Are there fixed assets that are not depreciable assets. For example 25000 x 25 6250 depreciation expense. Which of the following is considered a Section 1231 asset.

Current assets such as accounts receivable and inventory are not depreciated. The land is classified as real property but it can NOT be depreciated even though it is a business asset. Select all that apply.

Assets That Can And Cannot Be Depreciated Accountingo

Intercompany Transactions Of Non Current Assets Depreciable Assets

Assets That Can And Cannot Be Depreciated Accountingo

Fully Depreciated Asset Overview Calculation Examples

Solved Problem 62 For Each Of The Assets In The List Below Chegg Com

Assets That Can And Cannot Be Depreciated Accountingo

What Is An Asset S Depreciable Basis Accounting Services

Solved Question 1 12 Which Asset Is Not Depreciable Chegg Com

Assets That Can And Cannot Be Depreciated Accountingo

Solved Question 1 1 Point Factors To Consider In The Chegg Com

Solved Land Is Not A Depreciable Asset Because Select One O Chegg Com

Solved 1 Under Which Method Of Depreciation Is An Asset S Chegg Com

Definition Depreciation Is A Measure Of The Wearing Out Consumption Or Other Loss Of Value Of A Depreciable Asset Arising From Use Effluxion Of Time Ppt Download

Depreciation Selling A Depreciable Asset Accountingcoach

Assets That Can And Cannot Be Depreciated Accountingo

Answered On January 1 20 A Depreciable Asset Bartleby

Comments

Post a Comment